Child Care Tax Credits on IRS Form 2441

If you pay for child care for your kids, you may be eligible for a tax credit for a portion of the amounts paid to the child care provider. The credit is calculated on IRS Form 2441.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Patreon: https://www.patreon.com/jasonknott

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Taxes #1099NEC

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal, or accounting strategies demonstrated in this video. Thank you.

-

3:56

3:56

Jason D Knott

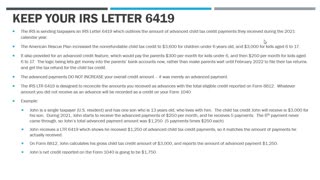

2 years agoIRS Letter 6419 and the Child Tax Credit (Form 8812)

372 -

1:38

1:38

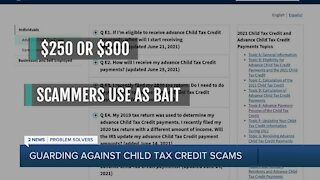

KJRH

2 years agoChild Tax Credit

68 -

3:50

3:50

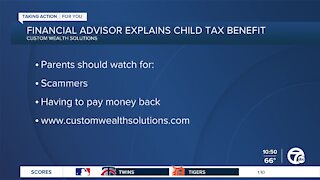

WXYZ

2 years agoChild Tax Credit Payments

1131 -

4:37

4:37

ClearValueTax

3 months agoChild Tax Credit 2024 Update_ Tax Refunds and IRS Filing

773 -

2:06

2:06

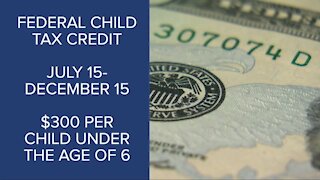

KJRH

2 years agoChild Tax Credit

4961 -

3:17

3:17

WFTS

2 years agoHow to make the most of your child tax credits

8 -

0:48

0:48

KMGH

2 years agoChild tax credit will impact your tax return

26 -

1:46

1:46

WKBW

3 years agoChild tax credit explained

206 -

2:37

2:37

christoff77

1 year ago2023 IRS Update of Child Tax Credit

14 -

2:17

2:17

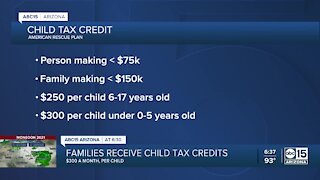

KNXV

2 years agoFamilies starting to receive child tax credits

24